montgomery county al sales tax registration

The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000. If you need assistance please call 334 832-1697.

How To Get A Business License In Alabama Truic

These records can include Montgomery County property tax assessments and assessment challenges appraisals and income taxes.

. Taxpayer Bill of Rights. A public parking deck can be accessed. Place the sticker on your windshield - Place your registration sticker on your car - its the only sticker you need.

New Resident Tax 90 or Sales Tax 625 state registration inspection and emissions fees. 3rd Floor Montgomery AL 36104 Phone. The offices are located on the 2nd floor.

On June 21 2018 is that an out-of-state seller with no physical presence in Alabama ie remote seller is required to collect and remit Alabama sellers use tax through the Simplified Sellers Use Tax SSUT program if total retail sales taxable and nontaxable into Alabama for the previous calendar year are above 250000. Once you register online it takes 3-5 days to receive an account number. Montgomery County Tax Office Tammy J.

County and state tax rates for Sales Use Tax. Find Montgomery County Tax Records. Things to do in Montgomery County.

The mailing address has not changed. In order to minimize processing time please present your tag renewal notice previous registration receipt or tag number and your Alabama driver license or non-driver ID. If the property is not redeemed within the 3 three year redemption period Sec.

MONTGOMERY COUNTY BUSINESS LICENSE APPLICATION. Lawrence Street Montgomery AL 36104. Free viewers are required for some of the attached documents.

Motor FuelGasolineOther Fuel Tax Form. Interest For questions or assistance phone 334 625-2036 3. 103 North Perry St Montgomery AL 36104 334 625-4636.

101 S Lawrence Street. It serves as proof. If you do not have one please contact Montgomery County at 334 832-1697 or via e-mail.

Montgomery Countys Vendor Registration Form and Commodity ClassSubclass Code Director are provided below. It will contain every up-to-date form application schedule and document you need in the city of Montgomery the county of Montgomery and. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return your local taxpayer ID number assigned to you by these jurisdictions.

This division oversees the collection of sales tax use tax and business taxes which include lodging gasoline and whiskey. Box 1111 Montgomery AL 36101-1111 4. If you need information for tax rates or returns prior to 712003 please contact our office.

Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. Search Jobs Agendas Minutes Employee Login. Effective JUNE 1 2022 please begin remitting sales business tax and business license returns and payments to the remittance address below.

SALES Retail or Wholesale. Consumer Use Tax Registration. Find out with a business license compliance package or upgrade for professional help.

As you enter the building from Lawrence Street please take the elevator to the 2nd floor. Montgomery County AL Home Menu. Business Tax Online Registration System.

Provide an estimate of gross receipts in the State of Alabama for fiscal tax year. SalesSellers UseConsumers Use Tax Form. 334-625-2994 Hours 730 am.

Montgomery City Sales andor Use Tax. The Tax Audit Department is located in the Montgomery County Courthouse Annex III Building located at 101 S. Central Standard Time on or before the due date to be considered timely paid.

These tax sale procedures are unique to Montgomery County and may differ from those used in other. Sales Tax Audit. The Property Tax Division is responsible for advising and assisting county tax officials on departmental policies procedures and the laws of the State of Alabama concerning the assessing and registering of manufactured homes.

Obtain forms and information on registering state boards and agencies that. 101 South Lawrence St Montgomery AL 36104. If paying via EFT the EFT payment information must be transmitted by 400 pm.

For Levy Year 2021 the sale will take place on Monday June 13 2022 between 800 am. Instructions for Uploading a File. Eastern Time ET in the Division of Treasury Department of Finance located at 27 Courthouse Square Suite 200 Rockville Maryland 20850.

To schedule an appointment at our main office in Montgomery Alabama. Do you need to submit an Application For SalesUse Tax Registration in Montgomery AL. Print and fill out the vendor registration application 2 pages and mail your application to the following address.

10 of tax due. We also provide assistance to taxpayers and the general public concerning the policies procedures and laws as they pertain to. 40-10-29 the purchaser of the Montgomery County Alabama tax lien certificate can apply for a tax deed to the property by surrendering the Montgomery County Alabama tax lien certificate to the Judge of Probate who in turn issues a tax deed Sec.

_____ Fiscal period October 1 September 30. Renewals can be processed at any of our 4 locations. Penalty - Late Payment.

The Business License Office is located on the 2nd Floor of Courthouse Annex III. Montgomery County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Montgomery County Alabama. A-Z Listing of Services.

McRae - Tax Assessor-Collector 400 N. The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250 county sales tax. Voting.

The Montgomery County Sales Tax is collected by the merchant on all qualifying sales made within Montgomery County. COVID-19 Government Submit A Request. Find due date information for monthly quarterly and annual filings of taxes administered by Sales Use.

You can read full instructions on how to register select tax types through My Alabama Taxes Help. Montgomery County collects a 25 local. 101 South Lawrence Street 2nd Floor.

Total purchase price of machines and replacement parts used in compounding mining quarrying or manufacturing of.

Mini Truck Lsv Alabama Department Of Revenue

Appraisal Montgomery County Al

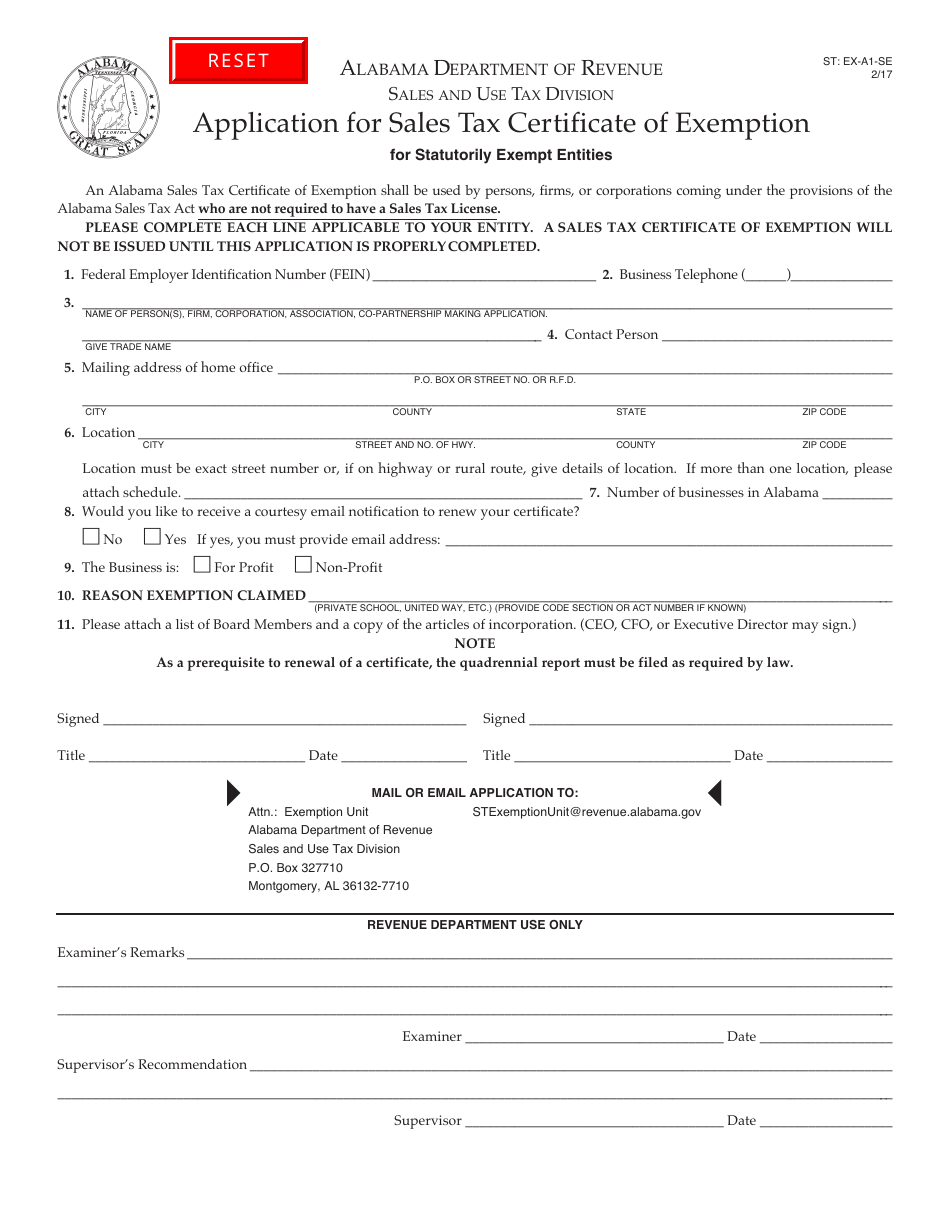

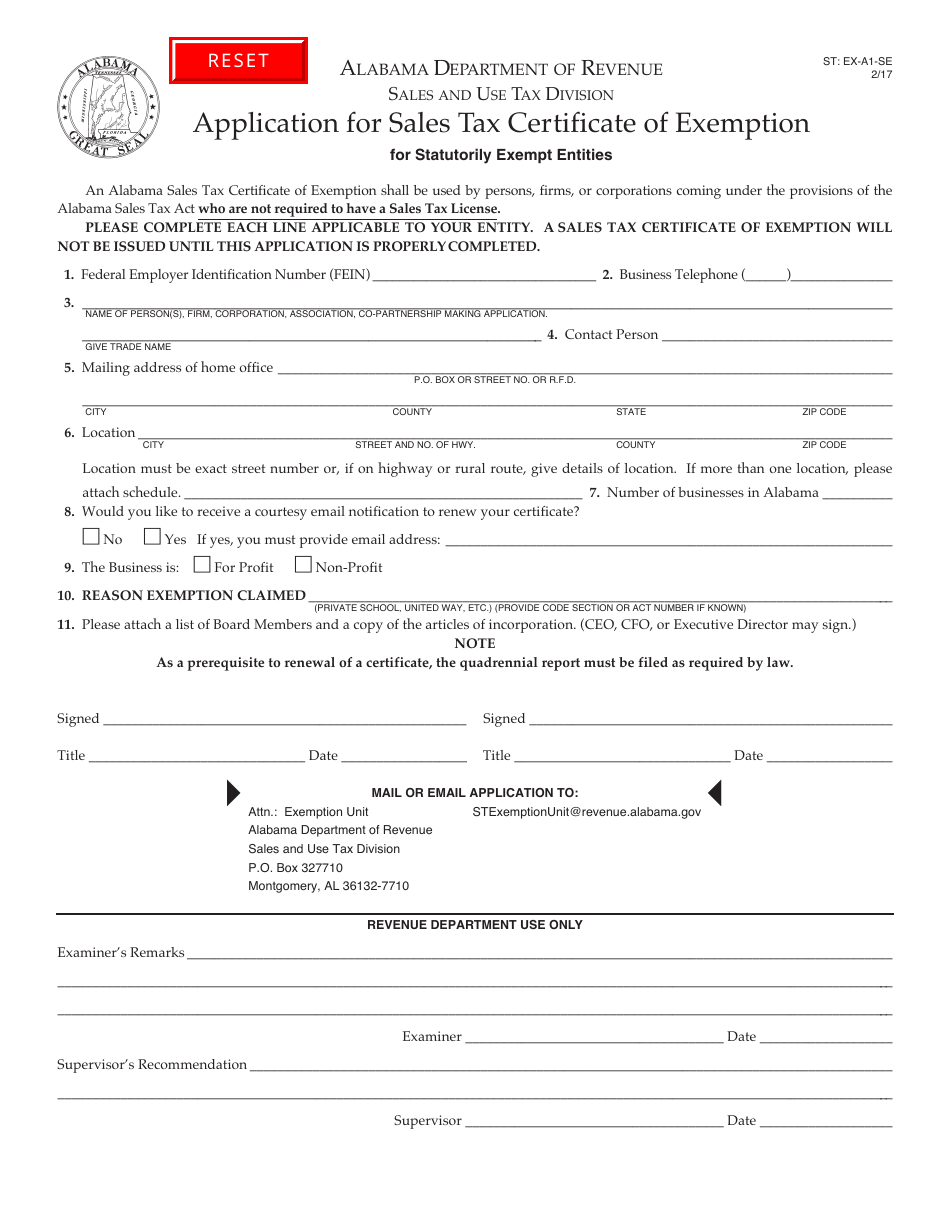

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Alabama Sales Tax Guide And Calculator 2022 Taxjar

How To Start An Llc In Alabama Legalzoom Com

Maintenance Districts Montgomery County Al

How To Get A Business License In Alabama Forbes Advisor

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax Audit Montgomery County Al

Labor Day Schedule Changes Closures Announced Happy Labor Day Montgomery County Day Schedule